Interim Financing Agreement Astra

Astra’s Financial Lifeline: Interim Financing Deal Unlocks New Horizons

Interim Financing Agreement Astra paves the way for renewed financial stability and growth.

Astra’s Interim Financing: Navigating the Path to the Stars

It’s no secret that the space industry is a challenging terrain, and Astra Space, a leading launch vehicle and spacecraft propulsion company, has found itself facing a financial crossroads. But as the saying goes, “necessity is the mother of invention,” and Astra has demonstrated its determination to reach the stars.

In a recent announcement that sent ripples through the industry, Astra Space shared its success in securing interim financing from two key investors. This financial boost provides the company with a lifeline, albeit a temporary one, giving them until the end of the coming week to secure additional funding.

The investors behind this interim financing are JMCM Holdings LLC and Sherpa Venture Funds II, LLP. These two entities are no strangers to Astra, being affiliates of early investors in the company. They have agreed to offer $13.4 million in “initial financing,” a welcome relief for Astra as they continue their mission to raise $15 million to $25 million, as initially outlined on October 23.

One crucial element of this financing deal is the purchase of an $8 million loan that Astra owed to an unnamed institutional investor from August. Astra had hit a financial stumbling block, defaulting on the terms of the loan agreement just the previous week. The consequence of this default was a substantial $3.1 million payment with a higher interest rate. This is where JMCM Holdings and Sherpa Venture Funds II stepped in, not only to cover the defaulted amount but also to provide a $3.05 million bridge loan due on November 17. In addition, they have acquired warrants for Astra stock, solidifying their support.

Astra had previously declared, on October 23, that JMCM Holdings would be the lead investor in a financing round valued at up to $25 million, with participation from Sherpa Venture Funds II. Each investor’s commitment was set at $5 million, reinforcing their belief in Astra’s vision. Sherpa Venture Funds II, often referred to as Acme II, is affiliated with Scott Sanford, who serves as the lead independent director on Astra’s board.

This timely financing arrangement involves an intriguing twist. The new investors have agreed to waive the default terms on both the previously held loan and the newly provided loan until November 17. Astra believes this extension will provide them with the time needed to raise additional liquidity through various capital raising strategies and cost-cutting initiatives.

In August, Astra made a strategic move by enlisting the services of investment bank PJT Partners. The goal was to identify “potential strategic investments in the Astra Spacecraft Engine business.” Industry insiders suggest that these investments might involve the sale of part or all of this subsidiary, which specializes in electric thrusters. This strategic maneuver opens up new possibilities for Astra, allowing them to focus on their core strengths while exploring potential partnerships or divestments.

Astra has faced challenges and had to make tough decisions. They prioritized their propulsion business, reallocating personnel in August to address a backlog of business worth a substantial $77 million at that time. This shift, though, resulted in a temporary slowdown in the development of the new Rocket 4 launch vehicle. Astra now anticipates a first test launch of this innovative rocket sometime in 2024.

While Astra’s journey has had its share of highs and lows, the recent drop in Astra’s stock value by more than 20% on November 6 on Nasdaq, closing at $0.73, served as a reminder of the volatile nature of the industry. However, the market reacted positively to Astra’s announcement of securing interim financing, with a rebound observed in aftermarket trading.

The value of Astra has undergone a remarkable transformation since it went public in July 2021 through a special purpose acquisition company (SPAC) merger. From its peak shortly after the merger, Astra’s value has decreased by more than 99%. This journey reflects the company’s resilience and commitment to overcoming obstacles and reaching new heights.

In the fast-paced world of space exploration, where innovation and adaptation are key, Astra Space continues to navigate the celestial path with determination and ingenuity. The recent financing deal serves as a testament to Astra’s unwavering commitment to its mission and its ability to overcome challenges along the way.

Join the conversation and share your thoughts on Astra’s journey. What do you think lies ahead for this pioneering company? Leave your comments below, and let’s explore the possibilities together.

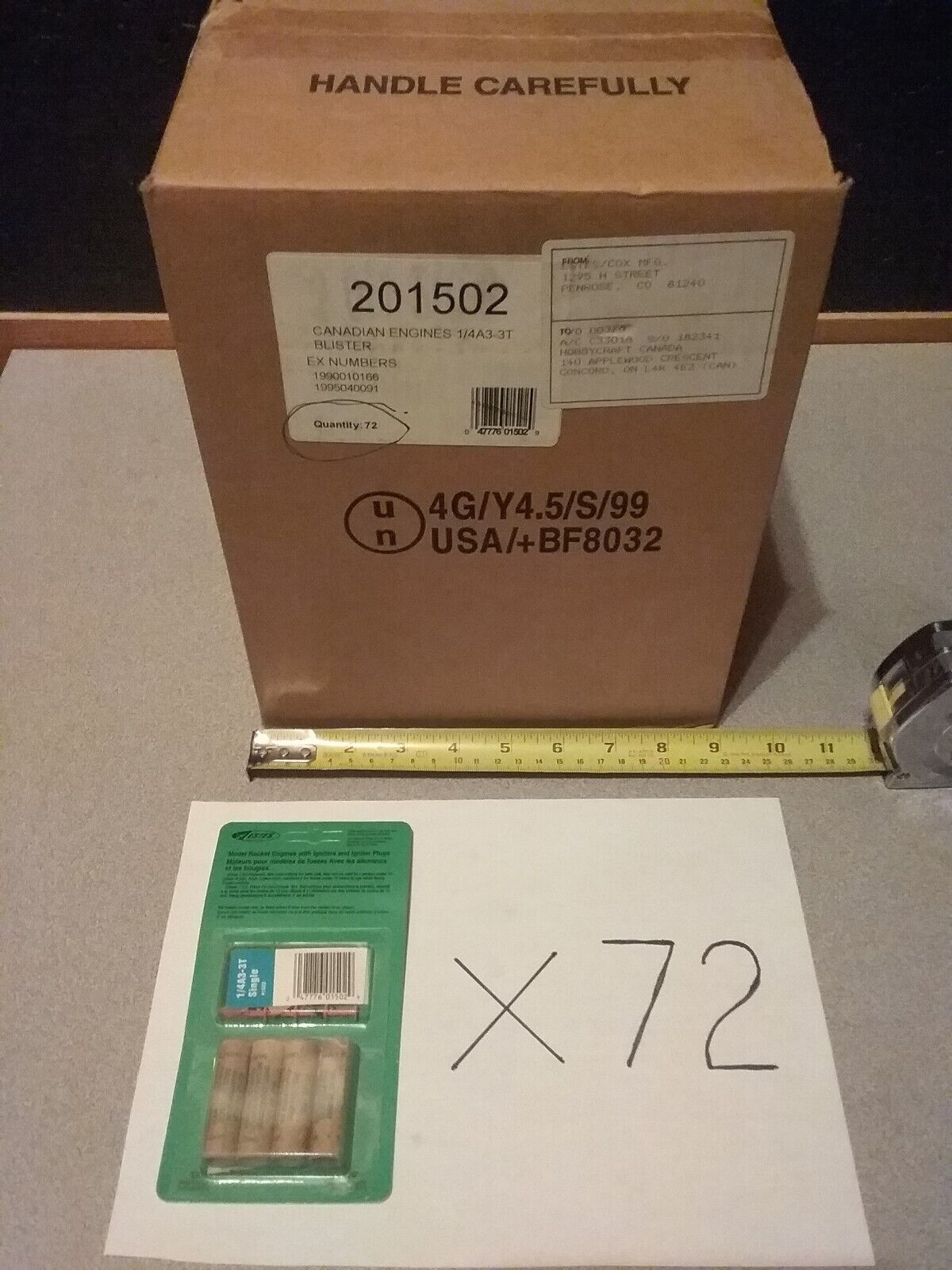

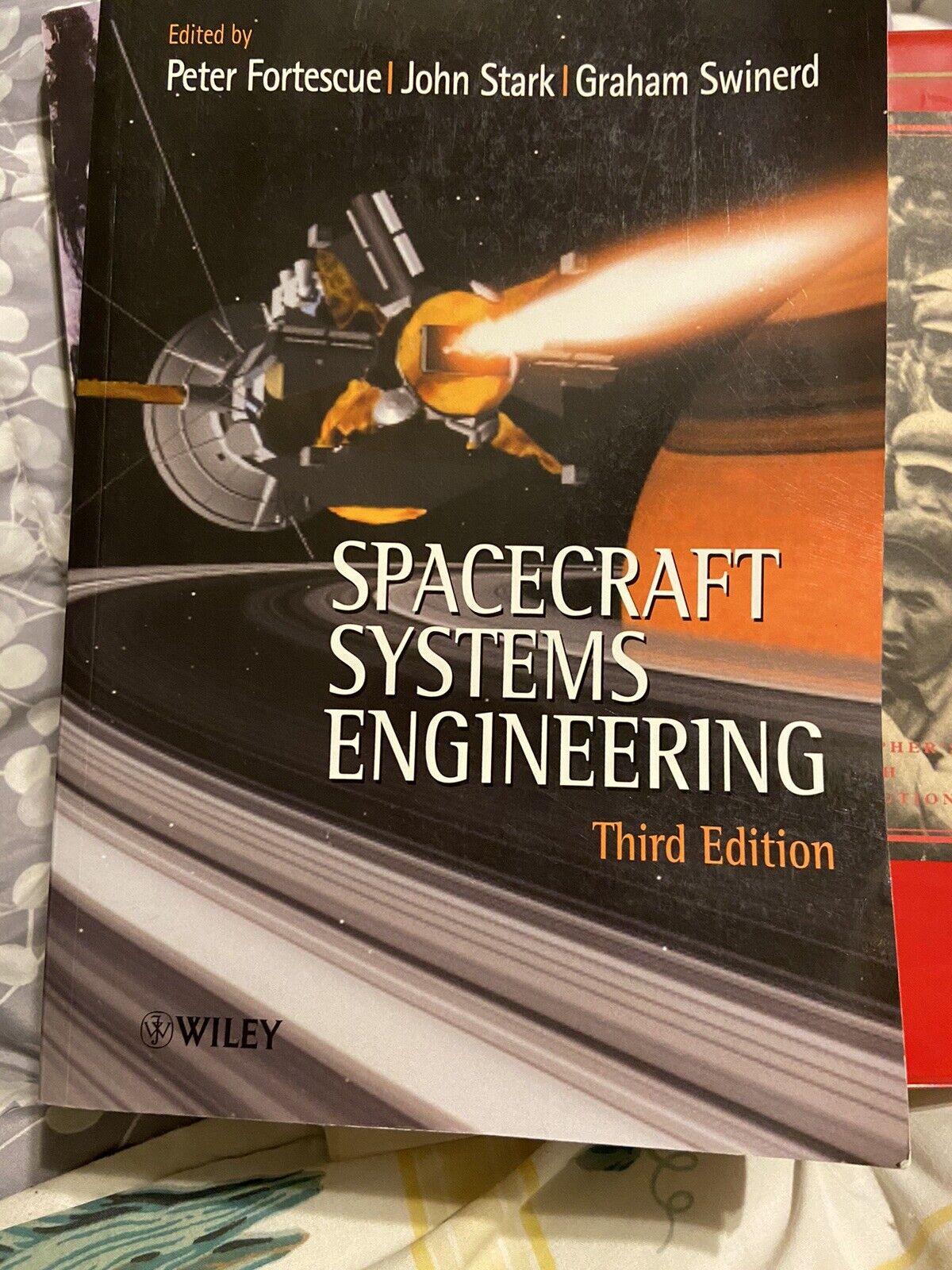

Are you intrigued by space exploration and the cutting-edge technology that powers it? As you’ve just read, Astra Space has secured crucial interim financing to further their spacecraft propulsion endeavors. Now, imagine being part of this exciting journey by exploring products that echo the innovation and precision behind spacecraft engines.

In our carefully curated selection, you’ll discover items that resonate with Astra’s commitment to advancing space technology. From educational resources about rocket propulsion to space-themed merchandise, these products will bring you closer to the fascinating world of space exploration. So, join us in this exploration of space-related products and take a piece of the cosmos home with you. Your adventure awaits in the following section.

Shop Products On Amazon

![Astra'S Financial Lifeline: Interim Financing Deal Unlocks New Horizons 10 Scifi Craft Engine Sound Effects Sound Effect Sounds Efx Sfx Fx Science Fiction Sci-Fi Science Fiction Spacecraft [Clean]](https://m.media-amazon.com/images/I/5104P2jBSPL.jpg)

Shop Products on Ebay

Trending Similar Stories in the News

Astra secures interim financing deal SpaceNews...

Astra Tech's BOTIM app offers services from flight bookings to bond Arab News...

Trending Videos of Interim Financing Agreement Astra

Astra Space: Funding Update, Settlement, and The Path Forward 8.31.23 $ASTR

Astra Space Stock: What They're Not Telling You #shorts

Astra’s Financial Lifeline: Interim Financing Deal Unlocks New Horizons

Similar Posts, Popular Now

Medicare Advantage Divestment Analysis

Tax Evasion Investigations

Canadian Premiers Carbon Tax

Donald Trump Civil Fraud Testimony

Donald Trump Civil Fraud Testimony

GIPHY App Key not set. Please check settings