Table of Contents

First-time Small Business Loan Tips

Unlocking Your Business Dreams: First-time Small Business Loan Tips

First-time Small Business Loan Tips: Mastering the Art of Financial Growth.

First-Time Small Business Loan Tips: Navigating the Financial Landscape

In the world of business, dreams often begin with an idea and the burning desire to make it a reality. Yet, to transform that idea into a thriving enterprise, it frequently requires an infusion of capital. For many entrepreneurs, this means venturing into the intricate realm of small business loans. To embark on this financial journey, understanding the intricacies of these loans is essential. This article provides a comprehensive guide on obtaining your first-time small business loan, covering not only the basics but also introducing novel perspectives to fuel a vibrant conversation.

1. The Cornerstones of Qualification

Key Takeaway: To qualify for a small business loan, you typically need a good personal and business credit score, collateral, and a business plan.

While the promise of a small business loan can be enticing, it’s crucial to recognize that not all applicants will meet the required criteria. Two fundamental aspects stand out: personal and business credit scores. Traditionally, lenders scrutinize both these scores to gauge an applicant’s financial trustworthiness.

Ava Roberts, a seasoned financial journalist, stresses the importance of these credit scores. “Maintaining a strong personal credit score, ideally 670 or higher, significantly bolsters your chances of loan approval,” says Roberts. This often becomes more critical for newer businesses with a limited credit history.

But the checklist doesn’t end there. Collateral and a well-structured business plan are equally vital. The collateral, which can include assets like real estate or equipment, serves as a safety net for lenders. A robust business plan, on the other hand, is the blueprint of your financial aspirations. It not only showcases your dedication but also provides a roadmap for potential lenders to assess your financial projections and strategies for business growth.

2. Types of Loans for First-Time Borrowers

Key Takeaway: A variety of small business loans cater to first-time borrowers, each designed for distinct needs.

Now that we’ve set the foundation for qualification, it’s essential to navigate through the extensive array of small business loans available. The right loan can make all the difference for a first-time borrower. Here are some of the most beneficial loan options:

-

Equipment Loans: If your business demands specialized equipment, this could be the answer. These loans are tailored to finance the purchase of necessary machinery, with loan amounts potentially extending into the millions. The best part? The equipment itself usually serves as collateral, simplifying the lending process.

-

Business Line of Credit: Versatility is the hallmark of a business line of credit. This revolving business loan allows entrepreneurs to tap into a pool of funds, repay them, and then draw from them again. It’s like a financial safety net that you can count on during challenging times.

-

Term Loans: If you seek predictability in loan terms and payments, a term loan might be your ideal choice. These loans come with predefined terms that must be repaid within a specific period, which can vary from six months to a decade or even longer.

-

SBA Microloans: For disadvantaged businesses, SBA microloans offer a ray of hope. These loans, usually capped at $50,000, come with relaxed lending criteria and are offered through nonprofit microlenders, often aiming to serve underserved communities.

-

Invoice Financing: If you run a business focused on business-to-business transactions, your unpaid invoices can serve as assets to secure funding. This approach differs from traditional lending criteria and can be an excellent option for those with outstanding invoices.

-

Merchant Cash Advance: In situations of financial urgency or when traditional loans are out of reach due to bad credit, a merchant cash advance could come to the rescue. These nontraditional loans advance money based on your future business sales, making it easier to secure funding when you need it most.

Each loan type has its unique features, terms, and suitability. Exploring these options is crucial for first-time borrowers, as it ensures that the chosen loan aligns with your specific needs and financial capacity. Furthermore, understanding the features such as minimum and maximum loan amounts, interest rates, and fees can significantly influence the borrowing costs.

3. Alternatives to Business Loans

Key Takeaway: If you’re unable to secure a traditional business loan, alternative financing options are worth considering.

Not every business will meet the strict requirements of traditional business loans. In such cases, it’s essential to explore alternative financing avenues:

-

Business Credit Cards: These cards come with a predefined credit limit, allowing you to manage cash flow and expenses efficiently.

-

Business Grants: Think of them as scholarships for businesses. They offer money to qualifying businesses without the obligation to repay. Each grant has specific qualifications, which might include submitting a business plan or presentation.

-

Crowdfunding: A modern twist on financing, crowdfunding allows businesses to raise capital through reward or debt crowdfunding, where a group of individuals comes together to fund a business loan.

These alternative options can be a lifeline for businesses that don’t meet traditional lending criteria. However, it’s crucial to ensure that you can manage the repayments while exploring these options.

4. Comparing Lenders

Key Takeaway: The lending landscape is diverse, with varying interest rates and loan features. It’s essential to choose the right lender that aligns with your business goals.

In the world of lending, no two lenders are the same. Even within the same category of loans, lenders often exhibit substantial variations in their offerings. This divergence in interest rates, loan features, and lending requirements necessitates a thorough comparison.

Liam Foster, a renowned financial analyst, emphasizes the significance of diligent research. Comparing lenders is the key to unlocking the perfect loan for your business,” he notes.

For example, some lenders specialize in short-term loans, while others are recognized for their prepayment discounts or low-interest rates. By comparing several lenders and their loan offers, you can pinpoint the ones that best suit your financial aspirations.

5. The Lending Universe

Key Takeaway: Traditional banks, online lenders, SBA, and microloans are at your disposal. Each has its unique advantages and disadvantages.

With numerous options to choose from, it’s essential to navigate the lending universe strategically. Here are the primary players in this domain:

-

Traditional Banks: They are a go-to choice, particularly if you already have an established banking relationship. While they often offer the lowest interest rates, they uphold stringent lending criteria.

-

Online Lenders: These fintech or nonbank lenders cater to a broader audience, making them accessible to borrowers who might not meet traditional lending requirements. Their online application processes offer speed and convenience.

-

Small Business Administration (SBA): If you don’t qualify for a conventional business loan, the SBA-backed loans are an excellent alternative. The SBA sets standards for the program, ensuring that loans come with capped interest rates and longer repayment terms.

-

Microloans: Geared toward startups and businesses with limited sales revenue, microloans are smaller in size, often capped at $50,000. They come with lenient lending criteria, making them accessible to a broader range of entrepreneurs.

Each option brings its strengths and weaknesses, making it crucial to weigh your priorities and lending criteria before making a choice. Your decision should align with your unique business needs.

6. Assembling the Arsenal: Necessary Information and Documents

Key Takeaway: Before applying for a business loan, prepare all the required documents to streamline the process.

Securing a business loan necessitates presenting a comprehensive overview of your financial status to the lender. While the exact documents might vary between lenders, several common requests are universal. These include personal credit history, business credit history, Employer Identification Number (EIN), business bank statements, balance sheets, business income tax returns, business licenses, proof of business formation, legal documents, business plans, collateral, and a detailed funding request.

Sophia Mitchell, a financial consultant, points out, “Gathering these documents in advance can expedite the loan application process, potentially speeding up the approval timeline.” It’s all about being organized and demonstrating your creditworthiness to the lender.

Your Financial Odyssey

In the realm of business, setting sail on your financial journey begins with the right tools and knowledge. Acquiring your first-time small business loan may seem like an intimidating quest, but with the right guidance and understanding, it becomes an attainable goal. The landscape of small business loans is diverse and dynamic, with opportunities for businesses of all shapes and sizes. By comprehending the intricacies of credit scores, loan types, and alternative financing, you empower your entrepreneurial dream. This guide equips you with the knowledge to navigate the lending universe, unlocking the capital needed to transform your vision into a flourishing business.

Join the Conversation: We’d love to hear your thoughts and experiences with small business loans. Have you secured a first-time loan, or are you considering one? Share your insights and engage with fellow entrepreneurs by commenting below.

Noah Ellis, NewsBurrow Press Team, NewsBurrow.com

[ad_1]

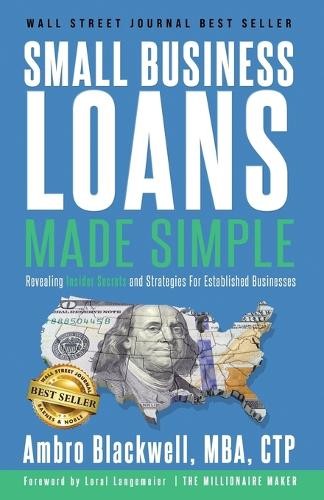

Are you ready to take your small business to the next level? In this comprehensive guide on first-time small business loans, we’ve equipped you with valuable insights, tips, and strategies to navigate the world of business financing successfully. As you’ve learned, securing the right business loan involves careful planning, credit assessment, and a keen understanding of your financial needs.

Now, as you prepare to make informed decisions for your business’s growth, consider exploring our selection of affiliate products in the “Business Loans” section. These offerings have been handpicked to complement the wisdom you’ve gained in this article. From tools that can help you manage your finances more efficiently to resources that guide you through the loan application process, these products are designed to support your entrepreneurial journey. So, without further ado, let’s delve into this curated collection and find the solutions that suit your unique business needs. Your success story begins here.

[ad_1]

Shop Products On Amazon

[ad_1]

Shop Products on Ebay

[ad_1]

Trending Similar Stories in the News

First-time small business loan: 6 things to know Yahoo Finance...

Business Loans Remain Hard to Get in 2023: Where to Turn for Help Bankrate.com...

[ad_1]

Trending Videos of First-time Small Business Loan Tips

SECRET to Startup LOANS Funding for Self Employed and New Business! Guide

Never Take A Loan For Starting A Business ✔️✔️

[ad_2]

Unlocking Your Business Dreams: First-time Small Business Loan Tips

Similar Posts, Popular Now

Biden loan investigation

Idaho special education standards

Downtown Pittsburgh Public Safety

Oregon Health Plan Renewals

Wynwood Co-Living Project Development

GIPHY App Key not set. Please check settings