Table of Contents

Spacex China Investment

Exposed: SpaceX’s Secret Dealings with China

SpaceX China Investment: A bombshell report reveals how Elon Musk’s company secretly allows investment from China, raising serious national security concerns.

Elon Musk’s SpaceX: Unveiling the Secret Chinese Investment and National Security Concerns

The meteoric rise of SpaceX, spearheaded by the visionary Elon Musk, has captivated the world. From revolutionizing space travel to aiming for Mars, SpaceX embodies American ingenuity and ambition. But beneath the gleaming facade of innovation lies a complex web of international finance, one that increasingly involves China. Is this a story of global collaboration, or a potential threat to national security? The answer, it seems, is shrouded in secrecy and offshore accounts.

SpaceX’s Ascent and China’s Ambitions: A Collision Course?

SpaceX’s impact on the aerospace industry is undeniable. It has slashed the cost of space launches, pioneered reusable rocket technology, and secured lucrative contracts with NASA and the Pentagon. Simultaneously, China has been aggressively pursuing its own space program, investing billions in satellite technology, manned missions, and lunar exploration. This convergence of ambitions sets the stage for a potential collision, especially when financial ties intertwine.

The narrative that SpaceX is solely an American enterprise is increasingly challenged by revelations of significant Chinese investment, albeit often hidden from direct view. This raises critical questions about the balance of power and influence in the future of space exploration and technology.

The Cayman Islands Connection: How Offshore Havens Facilitated Secret Investments

The investigation into SpaceX China Investment reveals a complex network of offshore accounts and shell companies, particularly those based in the Cayman Islands. These financial havens offer a cloak of secrecy, allowing investors to mask their identities and the true source of their funds. This practice, while not inherently illegal, raises eyebrows when the invested company is a major defense contractor.

It’s been reported that Chinese investors have acquired stakes in SpaceX through these offshore entities. This indirect route allows them to bypass the usual scrutiny applied to direct foreign investment in sensitive industries. The use of shell companies further complicates the picture, making it difficult to trace the ultimate beneficiaries of these investments.

The allure of offshore jurisdictions lies in their minimal regulatory oversight and favorable tax policies. However, this also makes them susceptible to misuse, potentially enabling the flow of funds from entities with questionable motives.

National Security on the Launchpad: Why Pentagon Eyes are Glued to SpaceX’s Finances

SpaceX’s role as a key player in the U.S. defense industry is paramount. The company provides critical launch services for military satellites and is involved in developing advanced technologies with potential military applications. This intimate relationship with the Pentagon makes the presence of Chinese investment a significant concern.

The fear is that Chinese investors, even with a minority stake, could gain access to sensitive information or exert influence over SpaceX’s operations. This could compromise U.S. national security by providing China with insights into advanced technologies or disrupting critical supply chains.

The potential for espionage or technology transfer is a constant worry. The Pentagon, along with intelligence agencies, is undoubtedly scrutinizing SpaceX’s financial arrangements to assess the true extent of the risk.

Musk’s Balancing Act: Navigating Tesla’s Success in China and SpaceX’s Scrutiny in the US

Elon Musk’s business empire is deeply intertwined with China. Tesla’s Shanghai factory produces nearly half of the company’s cars, making China a crucial market for the electric vehicle giant. This reliance on China puts Musk in a delicate position, as he must balance the interests of his various companies while navigating the complex geopolitical landscape.

Musk’s frequent meetings with Chinese officials to discuss business interests raise questions about potential influence. Critics argue that these ties could compromise his ability to act in the best interests of U.S. national security when it comes to SpaceX.

The scrutiny surrounding SpaceX’s Chinese investment highlights the challenges faced by multinational corporations operating in an increasingly polarized world. Balancing profit motives with national security concerns requires careful navigation and unwavering transparency.

CFIUS Under Fire: Is Regulatory Oversight Strong Enough to Detect Hidden Investment?

The Committee on Foreign Investment in the United States (CFIUS) is tasked with reviewing foreign investments for potential national security risks. However, the use of offshore entities and shell companies makes it difficult for CFIUS to effectively monitor and assess the true extent of foreign influence.

Critics argue that CFIUS needs greater authority and resources to penetrate the veil of secrecy surrounding these complex financial arrangements. Loopholes in existing regulations allow investors to bypass scrutiny, potentially undermining the effectiveness of CFIUS’s mission.

The SpaceX China Investment case underscores the need for a more robust and proactive approach to regulatory oversight. This includes strengthening international cooperation to combat financial secrecy and enhancing the ability to track funds flowing through offshore jurisdictions.

From Courtroom to Headlines: Unraveling the Investment Puzzle Through Legal Battles

Details of the Chinese investments in SpaceX surfaced during a corporate dispute in Delaware court. Testimonies from SpaceX’s CFO and investor Iqbaljit Kahlon revealed that the company considers indirect Chinese investments acceptable if routed through offshore accounts.

This revelation sparked a wave of media coverage and public outcry, forcing SpaceX to address the issue head-on. The legal proceedings provided a rare glimpse into the inner workings of the company’s financial strategy, exposing the extent to which it relies on foreign capital.

The courtroom drama served as a catalyst for greater scrutiny of SpaceX’s investment practices, prompting calls for greater transparency and accountability.

The $50 Million Deal That Wasn’t: A Glimpse into SpaceX’s Initial Hesitations

In 2021, SpaceX reportedly canceled a $50 million direct investment deal with a Chinese firm due to concerns about regulatory scrutiny and potential national security implications. This decision suggests that SpaceX was initially wary of direct Chinese involvement.

However, the subsequent reliance on indirect investment through offshore entities raises questions about whether this was a genuine change of heart or simply a strategic shift to circumvent regulatory hurdles.

The canceled deal provides a valuable insight into SpaceX’s internal deliberations and the evolving nature of its relationship with Chinese investors.

Echoes Across the Portfolio: Are Neuralink and xAI Following a Similar Funding Path?

The concerns surrounding SpaceX Chinese funding extend beyond the aerospace industry. Reports suggest that similar financial practices involving Chinese investors may be present in Elon Musk’s other ventures, including Neuralink and xAI.

Neuralink, which aims to develop brain-computer interfaces, and xAI, focused on artificial intelligence, are both strategically important technologies with potential national security implications. The presence of Chinese investment in these companies raises similar concerns about technology transfer and foreign influence.

This pattern across Musk’s portfolio suggests a systemic approach to raising capital, one that may prioritize access to funding over potential risks to national security.

Public Outcry and Political Pressure: How the News is Shaping the Future of SpaceX’s Investments

The revelations about SpaceX’s Chinese investment have sparked a significant public outcry. Critics have accused the company of prioritizing profit over national security and have called for greater transparency and accountability.

Politicians on both sides of the aisle have expressed concern about the potential risks posed by Chinese investment in strategic industries. Some have called for congressional hearings and legislative action to strengthen regulatory oversight and prevent future подобных ситуаций.

The combination of public pressure and political scrutiny is likely to shape the future of SpaceX’s investment policies, potentially leading to greater transparency and a more cautious approach to foreign capital.

Geopolitical Chessboard: How SpaceX’s Investment Strategy Impacts US-China Relations

The controversy surrounding SpaceX China Investment occurs against the backdrop of increasingly strained relations between the United States and China. The two superpowers are locked in a strategic competition for technological dominance and global influence.

The presence of Chinese investment in a key U.S. defense contractor like SpaceX adds another layer of complexity to this relationship. It raises questions about the extent to which the two countries can cooperate in areas of mutual interest while simultaneously competing for technological supremacy.

The SpaceX case highlights the delicate balance between economic interdependence and national security in an era of great power competition.

Shell Companies and Strategic Maneuvering: Decoding the Financial Playbook

The use of shell companies and offshore accounts is a key element of SpaceX’s financial strategy. These entities allow the company to raise capital from foreign investors while maintaining a degree of separation and obscuring the true source of the funds.

This approach provides SpaceX with greater flexibility in navigating complex international finance regulations. However, it also creates opportunities for abuse and raises concerns about transparency and accountability.

Understanding the intricacies of this financial playbook is crucial to assessing the true extent of Chinese influence and the potential risks to national security.

Beyond SpaceX: A Call for Broader Scrutiny of Foreign Investment in Strategic Industries

The SpaceX China Investment controversy serves as a wake-up call for the need for broader scrutiny of foreign investment in strategic industries. The current regulatory framework may not be adequate to address the challenges posed by complex financial arrangements and the growing influence of foreign powers.

Strengthening regulatory oversight, enhancing international cooperation, and promoting greater transparency are essential steps to protect U.S. national security and economic interests.

The future of American innovation and technological leadership depends on our ability to strike a balance between welcoming foreign investment and safeguarding our strategic assets.

The case of SpaceX serves as a stark reminder that the pursuit of technological advancement must not come at the expense of national security. As global power dynamics continue to shift, it is imperative that we remain vigilant and proactive in protecting our strategic interests.

By fostering a culture of transparency, accountability, and robust regulatory oversight, we can ensure that the benefits of global collaboration do not come at the cost of compromising our national security.

What do you think? Join the conversation and share your opinions below.

The saga of SpaceX and its intricate financial dealings with China underscores a fundamental truth: the future of space exploration is not just about rockets and technology, but also about economics and investment. As we’ve explored the complexities of international finance and national security, it becomes clear that participation in the space economy is not limited to governments and corporations. Individuals can also play a role, and one exciting avenue is through strategic investments in space exploration.

For those captivated by the boundless potential of space and eager to be part of this groundbreaking era, investing in space exploration stocks presents a compelling opportunity. These investments not only support the companies pushing the boundaries of space travel and technology but also offer the potential for significant financial returns as the space economy continues to expand. Ready to explore the possibilities? Discover a curated selection of Space Exploration Stocks and take your first step towards becoming a stakeholder in the cosmos.

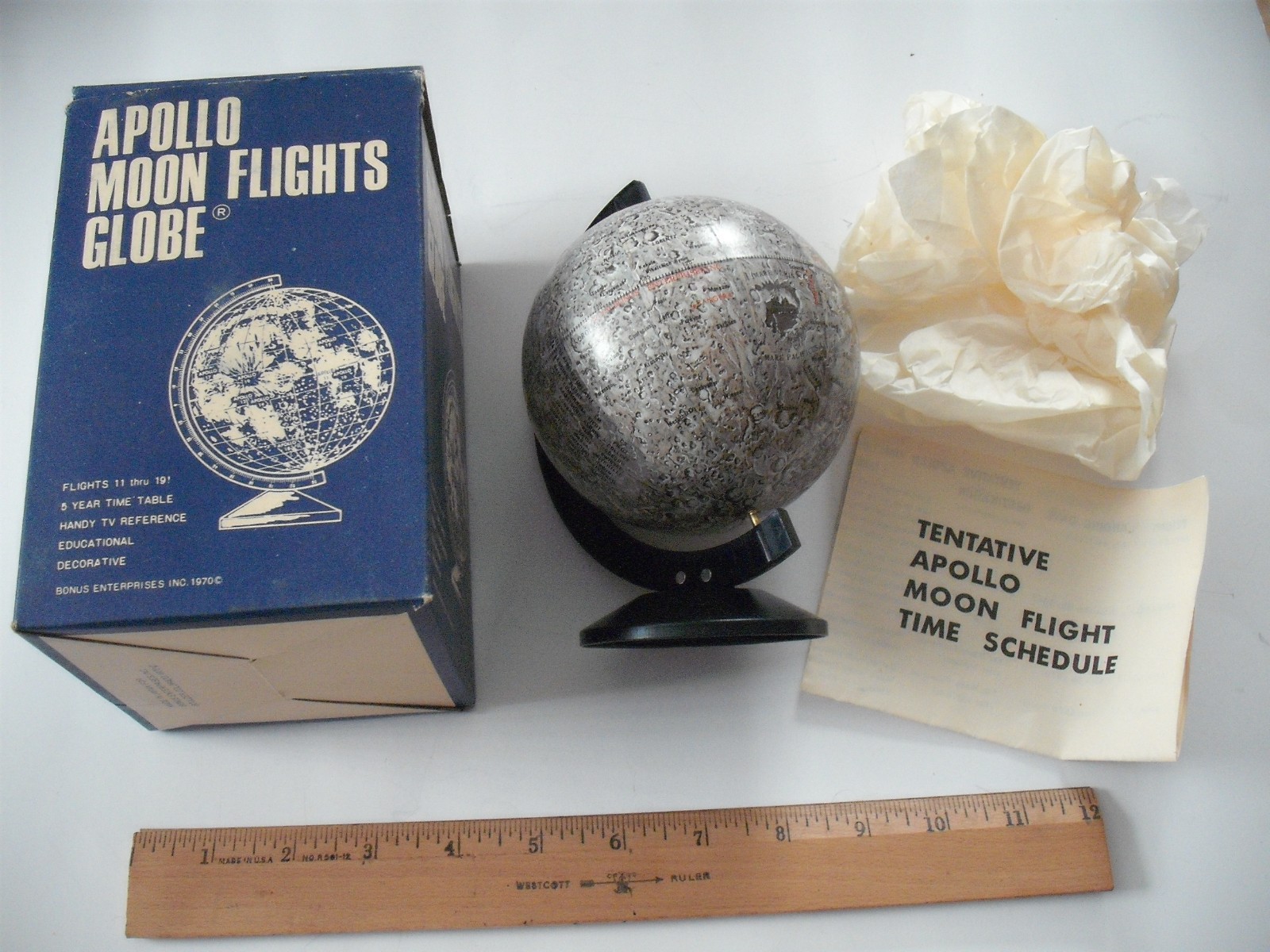

Shop Products On Amazon

Shop Products on Ebay

Trending Similar Stories in the News

How Elon Musk’s SpaceX Secretly Allows Investment From China ProPublica...

SpaceX reportedly has a secret backdoor for Chinese investment TechCrunch...

Trending Videos of Spacex China Investment

An Exclusive Conversation with Landspace - China's Answer to SpaceX

GIPHY App Key not set. Please check settings