Table of Contents

Florida Property Insurance Reform

Florida Property Insurance Overhaul: Relief Ahead for Homeowners

Florida Property Insurance Reform brings hope for homeowners grappling with insurance crisis as legislative session concludes.In a momentous turn of events, the Florida legislative session has drawn to a close, leaving a trail of anticipation in its wake. As the dust settles, all eyes turn to Governor Ron DeSantis, who holds the fate of several pivotal property insurance measures in his hands. With a unanimous decision, the Florida Legislature has embarked on a journey to tackle head-on the pressing issue of the property insurance crisis gripping the state. Among the array of measures passed is one that promises a glimmer of hope for homeowners: the initiative to allow alternative insurance carriers to absorb policies from Citizens Property Insurance. This strategic move aims to alleviate the burden on homeowners, especially those who found solace in Citizens’ embrace when private insurers turned their backs.

State Sen. Jim Boyd stands at the forefront of this legislative push, his unwavering optimism fueling the belief that tangible relief is on the horizon. With a steadfast commitment to steering Florida in the right direction, Boyd’s bill holds the promise of ushering in a new era of stability and security for property owners statewide. Yet, amidst the prevailing sense of progress, dissenting voices resonate within the political arena. Democrats voice concerns that the measures enacted may inadvertently tilt the scales in favor of insurance companies, rather than providing substantial relief to homeowners. State Rep. Anna Eskamani raises poignant questions about the true beneficiaries of these legislative endeavors, shedding light on the stark reality faced by Floridians grappling with an affordability crisis.

The intricacies of taxation further cloud the horizon, as discussions swirl around the implications of proposed tax breaks within the property insurance industry. While touted as a means of alleviating financial strain, these tax concessions prompt critical reflection on their ultimate impact on everyday Floridians. Florida House Minority Leader Fentrice Driskell voices apprehension, cautioning against the illusion of relief that may mask deeper systemic issues. In this nuanced landscape, bipartisan consensus emerges on the vital importance of bolstering the My Safe Florida Home program. With an infusion of funds, this program holds the potential to empower homeowners, particularly those from low-income backgrounds, to fortify their homes against the ravages of nature.

As the debate rages on, one undeniable truth emerges: the quest for comprehensive property insurance reform is far from over. While strides have been made, challenges persist, demanding a concerted effort to address the root causes of the crisis at hand. Governor DeSantis stands poised to leave an indelible mark on Florida’s insurance landscape, as he prepares to sign these transformative measures into law. With each stroke of the pen, the trajectory of countless homeowners hangs in the balance, underscoring the gravity of this pivotal moment in Florida’s history. As the sun sets on the legislative session, the journey toward equitable property insurance reform marches onward, fueled by the collective resolve to safeguard the homes and livelihoods of all Floridians.

[ad_1]

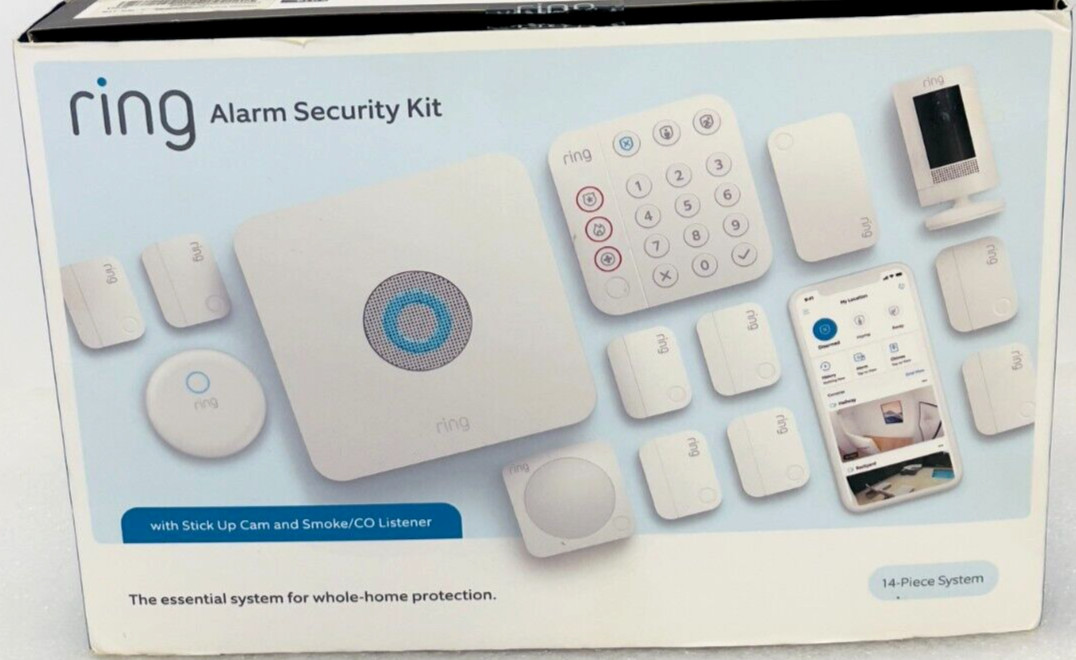

In the wake of the recent Florida legislative session, where measures were passed to address the property insurance crisis, it’s crucial for homeowners to consider bolstering their security measures. With the focus on reforming property insurance, the importance of safeguarding one’s home becomes paramount. As we navigate these changes, investing in home security products is not just prudent but essential. Whether it’s enhancing surveillance systems, fortifying entry points, or implementing smart technology, taking proactive steps to protect your property aligns with the broader efforts to secure peace of mind in uncertain times. Explore our curated selection of home security products below and safeguard your investment today.

[ad_1]

Shop Products On Amazon

[ad_1]

Shop Products on Ebay

[ad_1]

Trending Similar Stories in the News

Lawmaker, expert react to Florida legislature inaction on insurance WPBF West Palm Beach...

Can Lawmakers Save the Collapsing Florida Home Insurance Market? Bankrate.com...

Trending Videos of Florida Property Insurance Reform

Florida Gov. DeSantis signs property insurance legislation

[ad_1]

Similar Popular Articles

Florida Murder Hate Crime

OHSU COVID-19 Response

Edmonton Police Assault

Holi Weekend Getaways

[ad_1]

#FloridaPropertyInsurance, #InsuranceReform, #FloridaLegislature, #HomeownersRelief, #FloridaPolitics, #InsurancePolicy, #HomeownersInsurance, #PropertyInsurance, #FloridaLawmakers, #SessionEnds

Florida Property Insurance Reform, Legislative Session Ends, Homeowners Relief Measures, Insurance Policy Changes, Citizens Property Insurance, My Safe Florida Home Program, Insurance Premium Reductions, Florida Legislative Measures, Governor Ron DeSantis, Property Insurance Crisis

[ad_2]

GIPHY App Key not set. Please check settings