Table of Contents

Behavioral Insurance Programs

Revolutionizing Life Insurance: MassMutual’s Behavioral Insurance Program Unveiled

Behavioral Insurance Programs are revolutionizing the insurance industry, enhancing policyholder health and well-being.

Revolutionizing Insurance: MassMutual’s Behavioral Insurance Program

In a bold and innovative move, MassMutual is leading the charge in the insurance industry by embracing behavioral insurance. With the introduction of the MassMutual Health and Wellness Program, the company is not just providing insurance coverage; it is actively working to improve the health and longevity of its policyholders while reducing premature death claims.

A Paradigm Shift in Insurance

For years, behavioral insurance has been a staple in the realms of health, auto, and home coverage. It has leveraged customer behavior to underwrite, price, and make payouts accordingly. Auto insurers have offered discounts based on driving habits tracked through telematics and mobile apps. Health insurers have implemented wellness programs that reward policyholders for maintaining healthy behaviors. Home insurance providers even offer incentives for using smart security equipment. However, when it comes to life insurance, the adoption of behavioral criteria has been relatively slow.

MassMutual, however, recognized the value of this approach and took a pioneering step in the industry by introducing their MassMutual Health and Wellness Program. The program isn’t just a collection of tools and offerings; it’s a beacon of change. It empowers eligible policyholders with a deeper understanding of their health, enabling them to make informed decisions to lead longer and healthier lives.

Promoting Healthy Behaviors

At the core of this program is the promotion of healthy behaviors. Policyholders are offered a range of tools and research that provide insights into potential health risks and encourage the adoption of healthier lifestyles. This approach isn’t just about safeguarding the financial interests of the insurance company; it’s about genuinely caring for the well-being of policyholders.

A Focus on Prevention

One of the standout features of the MassMutual program is its research collaboration with Genomics PLC. Through genetic risk assessments, eligible policyholders gain insights into their likelihood of developing common diseases like diabetes, heart disease, and certain cancers. This is a groundbreaking approach, with approximately one in five policyholders discovering they may be at higher risk for preventable diseases. More importantly, about 71% of those who participated planned to take preventative action based on their genetic risk assessments. This includes recommended diagnostic tests and health and lifestyle modifications.

Enhanced Healthcare Utilization

The impact of these assessments is profound. The study revealed that reported healthcare visits within four months of receiving high-risk results doubled, underscoring the value of genetic assessments as a preventive tool. Encouraged by the success of this research collaboration, MassMutual is planning to expand the offering to additional policyholders. In doing so, they are set to become the first life insurance carrier to provide this level of genetic risk assessment.

What’s important to note is the commitment to policyholder privacy. MassMutual ensures that they are not privy to individualized genetic information, maintaining the highest standards of privacy and confidentiality. The partnership with Genomics PLC is all about empowering the policyholder with knowledge and options.

Cancer Detection for Early Intervention

Cancer, a devastating and often silent killer, is a major concern for many. MassMutual has addressed this issue by partnering with GRAIL, LLC, to provide eligible policyholders with access to multi-cancer early detection testing using GRAIL’s Galleri® test. This groundbreaking test can detect a shared cancer signal across more than 50 types of cancer, some of which lack other forms of screening.

This is more than just early detection; it’s about predicting the tissue or organ where the cancer signal originated, providing invaluable guidance for diagnostic evaluation. During the pilot program, nearly two dozen positive cancer signals were detected among the 2,200 participating policyholders. These cases are now under consideration with medical providers.

The success of the multi-cancer early detection program, with about 94% of participating policyholders reporting a positive overall experience, has prompted MassMutual to consider expanding this offering. It’s a testament to the growing demand among consumers for innovative solutions that empower them to take control of their health.

Incentivizing Healthy Behaviors

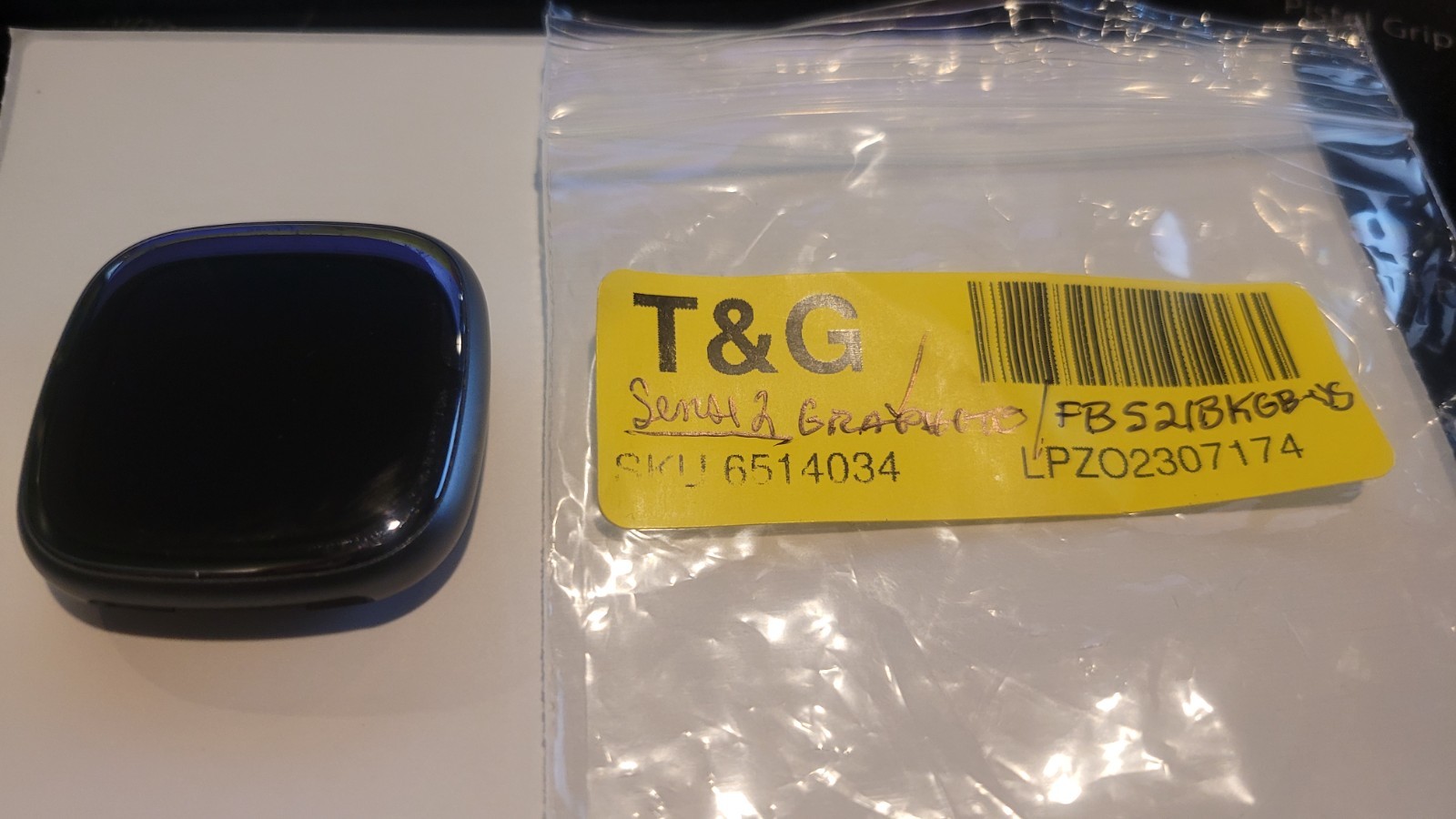

MassMutual is not just stopping at genetic risk assessments and cancer detection. They are exploring innovative ways to incentivize and reward healthy behaviors using data from wearable devices. The MassMutual Wellness-Enhanced Lifestyle & Longevity (WELL) Rider pilot, launched recently, offers new term life insurance policyholders the opportunity to earn cash incentives of up to 5% of their annual policy premiums. All they have to do is voluntarily track and report their physical activity and sleep data through the app.

This isn’t just about saving on premiums; it’s about encouraging a lifestyle that promotes better health and well-being. MassMutual is pioneering a new era where insurance isn’t just about financial protection; it’s about actively promoting a healthier life.

Embracing the Future of Insurance

While MassMutual’s behavioral insurance program is breaking new ground, it’s part of a growing trend in the industry. The insurance landscape is evolving, and the focus is shifting towards improving the lives of policyholders, reducing claims, and fostering lasting relationships.

Adam Fox, the head of distribution, technology, and data science for MassMutual, emphasizes the idea that what’s good for policyholders is good for the insurance company. These programs create value, which, in turn, opens up new segments for clients and builds deeper, long-lasting relationships. It’s a win-win situation where clients enjoy better mortality rates, file fewer claims, and, as a result, insurance companies can pay higher dividends.

A Growing Trend

MassMutual’s groundbreaking approach may be leading the pack, but it’s certainly not alone. Other insurers, such as Manulife International in Asia and Europe, have begun offering behavioral discounts and credits. This shift in the industry is not just a result of innovation; it’s closely tied to behavioral economics.

Behavioral economics, with its “nudge theory,” emphasizes the idea that by shaping the environment and choice architecture, one can influence the likelihood of one option being chosen over another. This means that insurance companies are working not just to provide coverage but to create an environment that nudges policyholders toward healthier, safer lives.

The Significance of Preventable Diseases

The importance of this shift can’t be overstated. More than 71% of deaths worldwide are related to just four chronic diseases: diabetes, respiratory ailments, cardiovascular disease, and various cancers. These diseases are, for the most part, linked to lifestyle choices, such as smoking, excessive alcohol consumption, poor nutrition, and lack of physical exercise.

By actively engaging policyholders in their health, providing them with the tools and knowledge to make better choices, and incentivizing healthy behaviors, insurance companies are poised to make a significant impact on public health.

The Future of Insurance

Adam Fox rightly points out that behavioral insurance is in its early days. Still, he predicts that we’ll see it continue to grow over the next several years. It’s not just a trend; it’s a transformation of the insurance industry.

As insurance providers increasingly become partners in their policyholders’ health and well-being, we can expect to see more innovative programs and initiatives like MassMutual’s emerging within the next five to ten years. The future of insurance isn’t just about coverage; it’s about actively enhancing and extending lives.

Join the Conversation

MassMutual’s journey into behavioral insurance has sparked a significant shift in the industry. What are your thoughts on this approach? How do you see insurance evolving to better serve the well-being of policyholders? Join the conversation and share your insights by leaving a comment below.

For more thought-provoking news and updates, keep following NewsBurrow Network. We’re committed to bringing you stories that shape the future.

[ad_1]

Are you ready to take control of your health and embrace a better, longer life? MassMutual’s innovative Health and Wellness Program is changing the game, and it’s time for you to join the revolution. In this era of behavioral insurance, where healthier choices lead to greater rewards, we’re introducing you to fitness trackers – your ultimate companions on the journey to well-being.

Our program is all about understanding your health and making informed choices. As you’ve read, it’s a comprehensive approach that empowers policyholders to live healthier and longer lives. And now, with fitness trackers, you can monitor your progress and stay motivated every step of the way. These devices provide real-time insights into your physical activity, sleep patterns, and more, giving you the data you need to make the right choices for your well-being.

Take the first step towards a healthier you. The MassMutual Health and Wellness Program, combined with fitness trackers, isn’t just a program; it’s a lifestyle choice. Embrace the future of insurance, take charge of your health, and discover the benefits that come with it. So, let’s explore fitness trackers and how they can complement your journey to a healthier and happier life.

[ad_1]

Shop Products On Amazon

[ad_1]

Shop Products on Ebay

[ad_1]

Trending Similar Stories in the News

MassMutual embraces behavioral insurance with new program Insurance News Net...

Mayo Clinic workers say they have terrible health insurance Minnesota Reformer...

[ad_1]

Trending Videos of Behavioral Insurance Programs

Five emerging tech-trends in the insurance industry

How innovation is changing the insurance industry

[ad_2]

Revolutionizing Life Insurance: MassMutual’s Behavioral Insurance Program Unveiled

Similar Posts, Popular Now

Mike Johnson Speaker Profile

Gig Economy Insurance Needs

DeSantis pro-Palestinian club controversy

Marathon Oil Dividend Announcement

Manufactured Home Park Legislation

GIPHY App Key not set. Please check settings