Table of Contents

Pge Pacificorp Washington Utility Acquisition

PGE Acquires PacifiCorp’s Washington Assets for $1.9B: What It Means for Your Rates

PGE PacifiCorp Washington utility acquisition marks a monumental $1.9 billion shift in the Pacific Northwest energy landscape, promising a new era of reliability and green energy growth for 140,000 customers.

By David Goldberg (@DGoldbergNews)

The $1.9 Billion Power Shift: A New Era for the Pacific Northwest Grid

In a move that has sent shockwaves through the regional energy sector, Portland General Electric (PGE) has officially crossed state lines, striking a monumental $1.9 billion deal to acquire PacifiCorp’s Washington utility assets. Announced on February 17, 2026, this transaction isn’t just a corporate merger; it is a fundamental restructuring of how power flows across the Pacific Northwest. For decades, the energy landscape in Washington and Oregon has been defined by stable, state-bound utilities, but the rising tide of data center demand and climate mandates is forcing a new playbook.

This acquisition brings roughly 140,000 Washington customers under the PGE umbrella, marking a dramatic expansion for the Portland-based utility. The deal is strategically timed, as PacifiCorp, a subsidiary of Berkshire Hathaway Energy, seeks to shed assets to improve liquidity and stabilize its financial standing following years of legal and regulatory pressures across its multi-state footprint. For PGE, the move represents an aggressive play to scale its operations and secure a dominant position in the burgeoning clean energy corridor of the Northwest.

The sheer scale of the transaction—covering 2,700 square miles and 4,500 miles of transmission lines—suggests that PGE is looking far beyond today’s revenue. They are building a fortress of infrastructure designed to withstand the volatile energy markets of the 2030s. “This is a targeted step toward ensuring the continued delivery of safe, reliable power,” stated Darin Carroll, PacifiCorp’s CEO, though many industry insiders see it as a necessary retreat for a company under significant financial strain. As the dust settles on the announcement, the true question remains: what does this mean for the families and businesses who keep the lights on?

The “shock factor” here isn’t just the price tag; it’s the partnership. PGE isn’t doing this alone. They have teamed up with Manulife Investment Management, which will take a 49% minority stake in the new Washington utility business. This infusion of private institutional capital into a public utility structure is a trend to watch, as it signals that the massive costs of the green energy transition are increasingly being shared with global investment funds, raising new questions about local control and long-term accountability.

Mapping the Transition: 140,000 Customers Move to a New Utility Giant

The geographic footprint of this deal is vast, primarily affecting the “Pacific Power” service areas that have long defined the energy identity of Central and Eastern Washington. Residents in Yakima, Walla Walla, Dayton, and Goldendale are about to see a change in the logo on their monthly statements. While PGE has promised a “seamless transition,” the reality of migrating 140,000 accounts into a new subsidiary regulated by the Washington Utilities and Transportation Commission (WUTC) is an administrative mountain that will take at least 12 months to climb.

To ensure local stability, PGE has committed to retaining current Washington-based employees and honoring existing labor agreements. This is a critical move intended to appease local unions and maintain the specialized knowledge required to manage the rugged terrain of the Columbia Basin grid. However, for many customers, the transition feels like being caught in the middle of a high-stakes chess game between two corporate titans. The focus now shifts to whether the “customer-centric approach” PGE prides itself on in Oregon will translate across the border.

The acquisition also brings a massive physical network into PGE’s portfolio. We are talking about 4,500 miles of transmission and distribution lines—a distance roughly equivalent to driving from Seattle to Miami and back. This infrastructure is the backbone of the region’s agricultural and industrial economy. PGE’s challenge will be upgrading these aging lines to handle the influx of renewable energy without passing the bill directly to the newly acquired customer base.

Below is a snapshot of the operational scale involved in this acquisition:

| Category | Scale/Details |

|---|---|

| New Customers | ~140,000 (Washington State) |

| Service Area | 2,700 Square Miles |

| Transmission Lines | 4,500 Miles |

| Key Regions | Yakima, Walla Walla, Goldendale, Dayton |

The $1.9B Price Tag: Deconstructing the Valuation of the PNW Grid

Analysts are closely scrutinizing the $1.9 billion purchase price, which represents a 1.4x multiple of the estimated 2026 rate base. In the world of utility finance, this is considered a premium valuation, reflecting the high quality of the assets being sold. PacifiCorp is parting with some of its crown jewels to shore up its balance sheet, while PGE is paying for the privilege of immediate scale. The deal is expected to be “accretive” to PGE’s earnings within the first full year of operation, a signal to Wall Street that the expansion will pay off quickly.

The involvement of Manulife Infrastructure Fund III adds a layer of complexity to the funding. By offloading 49% of the equity to Manulife, PGE reduces its own immediate capital requirement while bringing in a partner with deep roots in Pacific Northwest timber and agriculture. This strategic alliance allows PGE to maintain operational control while leveraging Manulife’s financial muscle to fund future infrastructure projects. It is a savvy move that minimizes the risk of over-leveraging PGE’s balance sheet during a time of high interest rates.

However, the financial narrative isn’t purely about growth. It is also about risk mitigation. PacifiCorp has faced “extraordinary pressure” due to diverging regulatory policies across the six states it serves. By divesting the Washington assets, PacifiCorp simplifies its regulatory burden, allowing it to focus on its “Pacific Power” and “Rocky Mountain Power” operations in Oregon, California, Idaho, Utah, and Wyoming. For PGE, the risk is different: they are now a multi-state utility, which means they must navigate the political and regulatory waters of Olympia, not just Salem.

Here is a simplified representation of the capital structure for the new Washington subsidiary:

PGE & MANULIFE OWNERSHIP SPLIT (Estimated) [==================== 51% PGE (Majority Owner/Operator) ] [================== 49% Manulife (Minority Equity Stake) ]

The ‘Pocketbook’ Impact: What Happens to Your Monthly Bill?

The burning question for every resident from Yakima to Walla Walla is simple: “Will my rates go up?” The short-term answer provided by PGE is a firm “no” regarding the transaction costs. PGE has explicitly stated that customers in both Washington and Oregon will not bear the costs of the acquisition or its financing. However, the long-term reality of utility rates is rarely that simple. As PGE takes over, they will likely seek new capital investments to modernize the grid, and those investments are traditionally recovered through rate cases.

Washington state has some of the most aggressive climate laws in the country, including the Clean Energy Transformation Act (CETA), which mandates a coal-free grid by 2025 and 100% clean energy by 2045. PacifiCorp had already been granted a 7.9% rate increase starting January 2026 to help fund this transition. As PGE assumes control, they inherit these mandates. The challenge for PGE will be finding a way to meet these “green” requirements more efficiently than PacifiCorp could, potentially leveraging their larger renewable portfolio to keep costs down.

There is also the “data center factor.” PGE’s Oregon operations have seen a staggering 14% growth in industrial demand, largely driven by the tech sector. If PGE can attract similar high-tech investment to Central Washington, the increased revenue from industrial giants could help offset the costs of residential infrastructure. In fact, some utilities have used data center growth to actually cut residential rates. Whether PGE can replicate this “tech-dividend” in Washington remains to be seen, but it is a primary pillar of their growth strategy.

- Rate Protection: Existing rate agreements remain in place through the 12-month transition.

- Coal Removal: PGE will continue the mandate to remove coal-based power from the Washington mix.

- Efficiency Gains: Shared corporate functions between Oregon and Washington are intended to reduce overhead.

- Industrial Buffers: Growing demand from tech could potentially subsidize residential grid upgrades.

A Strategic Retreat: Why PacifiCorp Is Folding Its Washington Hand

To understand why this deal happened, one must look at the mounting pressures on PacifiCorp. As a subsidiary of Warren Buffett’s Berkshire Hathaway Energy, the company has traditionally been a symbol of stability. However, the last few years have been anything but stable. Multi-billion dollar liabilities stemming from wildfire litigation in Oregon and the inherent difficulty of managing six different state regulatory environments have created a “liquidity crunch” that the company could no longer ignore.

CEO Darin Carroll’s comments about “diverging policies” are a polite way of describing a regulatory nightmare. Each state PacifiCorp serves has different goals for carbon reduction, coal retirement, and rate caps. Trying to keep everyone happy led to what the company calls “extraordinary pressure” on its financial stability and credit ratings. By selling the Washington assets, PacifiCorp secures a massive $1.9 billion cash infusion to shore up its defenses and simplify its operational map.

This move is a warning shot to the entire industry: the era of the “mega-utility” serving a half-dozen states with wildly different political leanings may be coming to an end. Regional specialization is becoming the new gold standard. For PacifiCorp, Washington was the outlier—a state with aggressive climate goals that often clashed with the coal-heavy infrastructure PacifiCorp uses to serve its Intermountain West customers. Divesting allows them to “align costs and benefits” for their remaining states while letting PGE take on the challenge of Washington’s green future.

The Renewable Engine: Taking Over the Marengo and Goodnoe Hills Farms

PGE isn’t just buying customers and wires; they are buying some of the most productive renewable energy assets in the region. The deal includes three major generation facilities that are critical to Washington’s clean energy goals. These assets are the “green engines” that will drive PGE’s expansion and help them meet the strict requirements of the Washington Clean Energy Transformation Act. By acquiring these existing, operational plants, PGE skips years of development risk and construction delays.

The crown jewel of the generation package is the Chehalis natural gas plant, a 477-megawatt facility that provides essential “firm” power—the kind of energy that keeps the grid stable when the wind isn’t blowing. But the real story for the future lies in the wind assets. PGE is taking over the Marengo I and II wind facilities near Dayton (234 MW) and the Goodnoe Hills wind facility near Goldendale (94 MW). Together, these wind farms represent a massive slice of the region’s renewable capacity.

However, the acquisition of a gas plant like Chehalis in a state that is aggressively moving away from fossil fuels is a bold and controversial move. Critics argue that any investment in gas is a step backward, while grid operators insist it is the only way to ensure reliability during peak winter and summer loads. PGE’s management of this “bridge” facility will be a major test of their ability to balance climate goals with the physical realities of the power grid. They must convince Washington regulators that keeping Chehalis online is a necessity, not a liability.

| Generation Facility | Type | Capacity (MW) | Location |

|---|---|---|---|

| Chehalis Plant | Natural Gas | 477 MW | Chehalis, WA |

| Marengo I & II | Wind | 234 MW | Dayton, WA |

| Goodnoe Hills | Wind | 94 MW | Goldendale, WA |

| TOTAL CAPACITY | Mixed | 805 MW | – |

Beyond the Border: Why PGE is Betting Big on Washington

For Portland General Electric, this move is about survival through scale. As a single-state utility in Oregon, PGE was increasingly vulnerable to regional market fluctuations and the massive capital requirements of the energy transition. By expanding into Washington, they increase their rate base by approximately 18%, providing a larger foundation to spread out the costs of new technology, such as battery storage and advanced grid management systems. This “geographic diversity” makes the company much more attractive to long-term investors.

There is also a significant “load growth” play at work here. Washington’s I-5 corridor and the Columbia Basin are seeing an explosion in industrial activity, particularly in high-tech manufacturing and AI infrastructure. PGE has a proven track record of managing these “large load” customers in Oregon, where they have signed data center contracts totaling hundreds of megawatts. Expanding into Washington allows them to capture that same growth in a neighboring market, effectively becoming the “preferred utility” for the tech giants of the Pacific Northwest.

But let’s talk about the “shock factor” for the residents of Portland. Does this mean PGE’s focus will drift away from its home base? Management says no, arguing that “shared corporate functions” will actually make operations in both states more efficient. By using the same billing systems, engineering teams, and customer service centers for both states, PGE expects to drive down the cost-per-customer. It is the classic “economies of scale” argument, but if the integration stumbles, PGE could find itself fighting fires on two fronts instead of one.

The Regulatory Gauntlet: Navigating the WUTC and Federal Oversight

While the agreement is signed, the deal is far from done. The “regulatory gauntlet” is just beginning. PGE must now win approval from the Washington Utilities and Transportation Commission (WUTC), a body known for its rigorous defense of consumer interests. The WUTC will scrutinize every inch of this $1.9 billion deal, demanding proof that it won’t lead to higher rates or lower service quality for Washingtonians. This process is expected to take at least 12 months, with a target closing date in the latter half of 2026.

A major point of contention will likely be the 49% ownership stake held by Manulife. Regulators typically prefer utilities to be owned and operated by a single, transparent entity. Bringing in a massive investment fund as a minority partner adds a layer of complexity that the WUTC will want to peel back. They will want to know exactly how much influence Manulife will have over day-to-day operations and whether the pursuit of investor returns will ever come at the expense of local grid reliability.

Furthermore, federal oversight from the Federal Energy Regulatory Commission (FERC) will be required to approve the transfer of 4,500 miles of transmission lines. These are not just local wires; they are part of the interconnected Western Grid. Federal regulators will ensure that the sale doesn’t negatively impact the stability of the entire Western United States power market. It is a high-wire act for PGE’s legal and regulatory teams, who must prove that this acquisition is a “win-win-win” for the company, the customers, and the regional grid.

- WUTC Filing: PGE and PacifiCorp will submit their joint application for asset transfer.

- Public Comment: Residents and advocacy groups will have their say in public hearings.

- Financial Audit: Regulators will dive into the $1.9B valuation to ensure it is fair.

- FERC Review: Federal experts will check for regional grid stability and competition impacts.

- Final Order: WUTC issues a decision, often with specific “conditions” for approval.

Future-Proofing the Northwest: The Looming Era of Energy Independence

As we look toward the 2030s, this acquisition appears to be a foundation stone for a more unified, resilient Pacific Northwest energy market. The traditional model of isolated, state-specific utilities is buckling under the weight of climate change and soaring demand. By merging these Washington assets into the PGE family, the region moves one step closer to a synchronized grid capable of shifting wind and solar power seamlessly across state lines. This is energy independence in the making.

The “green energy transition” is no longer just a buzzword; it is a multi-billion dollar engineering project. PGE’s acquisition of the Marengo and Goodnoe Hills wind farms, combined with their existing portfolio, makes them one of the leading renewable operators in the West. This scale allows them to invest in the “next big thing”—massive battery energy storage systems (BESS). In fact, alongside the PacifiCorp deal, PGE announced two new solar and battery hybrid projects totaling 615 MW. This is the future: capturing the wind and sun of the Columbia Basin and storing it for when the region needs it most.

For the residents of the Pacific Northwest, the message is clear: the way you get your power is changing, and the companies providing it are evolving to survive. This $1.9 billion transaction is a bold gamble that scale, regional focus, and private partnership are the keys to a reliable, affordable future. As the regulatory reviews begin and the transition plans are drawn, all eyes will be on PGE to see if they can truly deliver on the promise of a “customer-centric” energy revolution. The power, quite literally, is shifting.

What do you think about this massive energy shift? Will PGE be a better steward of Washington’s grid than PacifiCorp? Join the conversation on social media and share your thoughts using #PNWEnergy and #NewsBurrow.

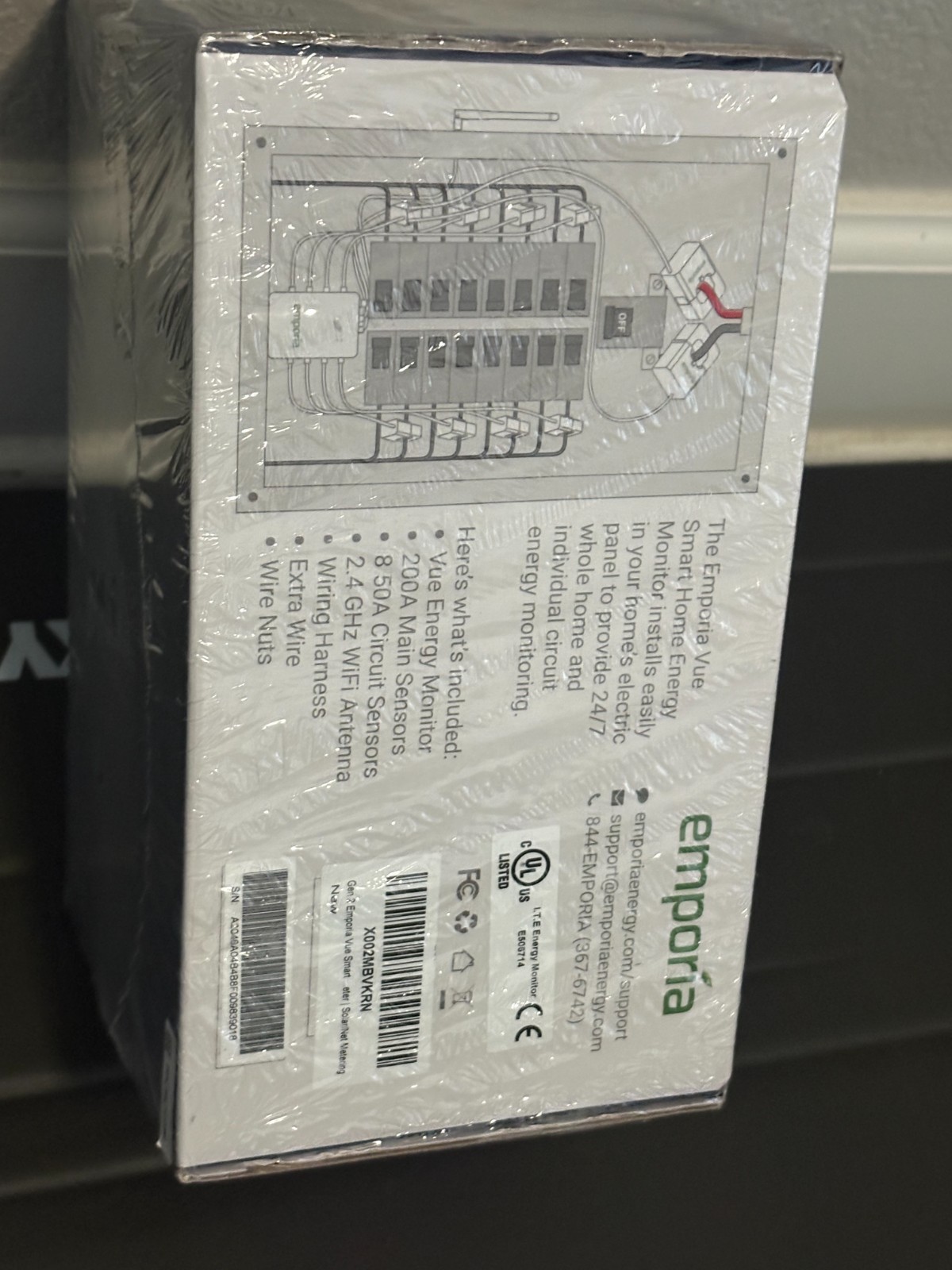

As the Pacific Northwest transitions into this new era of utility management, many residents are naturally concerned about the long-term transparency of their energy costs. While the merger between PGE and PacifiCorp promises a focus on reliability, the most effective way to protect your household budget is to take direct control of your own consumption data. Relying solely on a monthly statement—often received weeks after the energy was actually used—leaves many families in a reactive cycle of “bill shock” that is difficult to break.

Modern energy management has evolved far beyond simply turning off unused lights or adjusting the thermostat by a single degree. In the current climate of regional grid restructuring and rising demand from the tech sector, having real-time visibility into which appliances are driving your costs is no longer a luxury but a strategic necessity. By identifying “vampire loads” and inefficient devices before they impact your statement, you can effectively audit your own home and hold your utility provider accountable for every kilowatt-hour.

We have curated a selection of professional-grade tools designed to give you this exact level of oversight, allowing you to monitor your electrical signature with the precision of a grid engineer. These systems integrate seamlessly with your existing infrastructure to provide actionable insights directly to your smartphone, ensuring you stay ahead of any regional rate shifts. Join the NewsBurrow community by sharing your energy-saving tips in the comments below, and subscribe to our newsletter for exclusive updates on the latest utility news and household technology.

Shop Products On Amazon

Shop Products on Ebay

Trending Similar Stories in the News

PGE will expand to Washington state, acquiring swath of PacifiCorp territory OregonLive.com...

PGE looks to acquire PacifiCorp's Washington utility assets for $1.9B KGW...

Trending Videos of Pge Pacificorp Washington Utility Acquisition

Northwest Energy Leader's Vision of the Future

GIPHY App Key not set. Please check settings