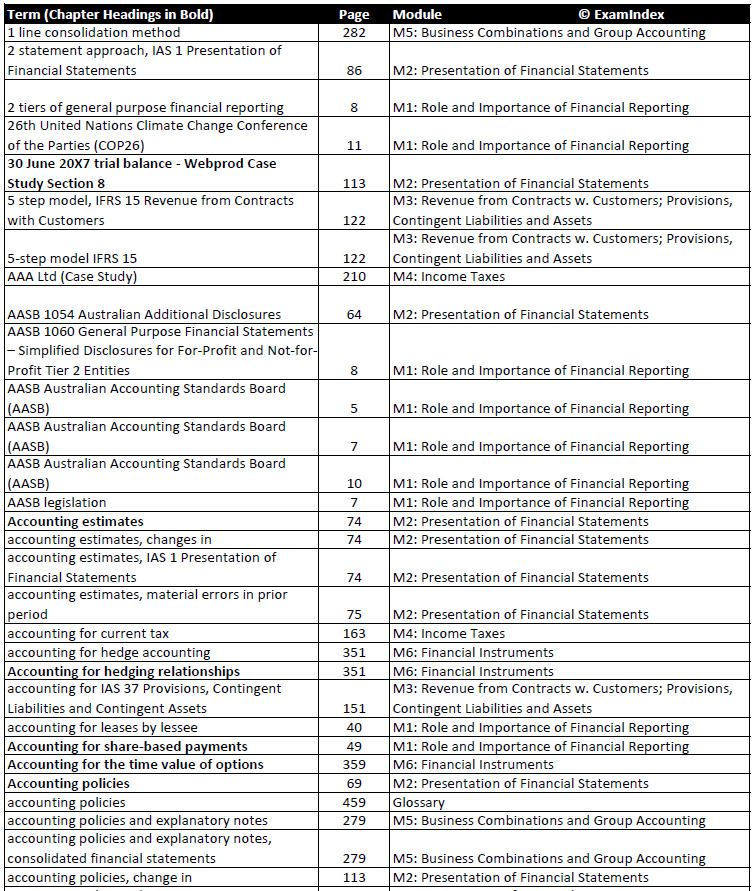

Table of Contents

China Evergrande Bankruptcy Crisis

China Evergrande Bankruptcy Crisis: Unraveling the World’s Biggest Property Developer

China Evergrande Bankruptcy Crisis continues to send shockwaves through China’s property market and financial system, posing a significant threat to its economy.

NewsBurrow News Network – Bringing You the Latest Insights

China Evergrande Bankruptcy Crisis: Unraveling the Economic Quagmire

In the corridors of global finance, China Evergrande’s debacle is no longer a slow-moving train crash; it’s an explosive reckoning that threatens to disrupt not only the world’s most indebted property developer but also the broader Chinese economy. The recent filing for bankruptcy protection, nearly two years after Evergrande defaulted on payments to creditors, has sent shockwaves through financial markets. With over $300 billion in debt, this once-mighty behemoth is now drowning in a sea of financial turmoil.

The Rise and Fall of Evergrande

Evergrande, once hailed as China’s biggest property developer, embarked on a meteoric rise driven by reckless borrowing and aggressive overbuilding. Its ambitions knew no bounds – from purchasing a soccer club to owning theme parks and even venturing into the electric vehicle market. As the company spiraled into an extravagant spending spree, it became a symbol of the excess fueled by China’s property bubble.

However, the Chinese government’s crackdown on excessive debt brought this extravagant journey to an abrupt end. Regulators tightened the reins on property developers, making it increasingly difficult for them to continue their borrowing frenzy. Evergrande’s business model, heavily reliant on easy access to credit, swiftly crumbled under the pressure.

The Current Conundrum

China Evergrande’s problems can be boiled down to two major crises that are wreaking havoc simultaneously.

First, the company is grappling with overseas creditors in a bid to restructure a colossal $30 billion worth of defaulted debt and other claims. However, reaching a consensus has proved arduous, especially as slumping property sales squeeze Evergrande’s cash flow. The recent cancellation of meetings with creditors underscores the gravity of the situation.

Second, the unfolding financial drama is further complicated by a series of criminal investigations targeting both current and former officials of the company. The police in southern China have detained staff at Evergrande’s wealth management arm, taking “criminal compulsory measures.” Additionally, the company’s former chief executive, former chief financial officer, and former chairman of its life insurance unit have also faced detention.

The most striking revelation is the suspicion of criminal wrongdoing surrounding Hui Ka Yan, Evergrande’s chairman and billionaire founder. Authorities have reportedly placed him under police surveillance, effectively placing him under a form of house arrest. While the specifics of these investigations remain undisclosed, their implications for the company are ominous.

The Broader Implications

Evergrande’s descent into financial turmoil is not an isolated case; it’s part of a broader trend. Over the past three years, more than 50 Chinese property developers have either defaulted on their debt or failed to meet their financial obligations. This alarming trend emerged in the wake of the Chinese government’s crackdown on rampant borrowing by real estate firms.

The handling of Evergrande’s crisis by Chinese authorities holds significant implications for how similar situations involving property developers will be managed in the future. Another major player, Country Garden, is teetering on the brink, adding to the urgency of finding a resolution to the Evergrande quagmire.

Moreover, Evergrande’s mammoth debt extends its repercussions to the backbone of the Chinese economy – small and midsize businesses. These enterprises are still waiting for their dues, with the company owing a staggering $82 billion to suppliers of construction materials alone. In a time when China is grappling with economic challenges, Evergrande’s unpaid bills serve as a heavy burden that ripples across the nation.

Join the Conversation

As we delve deeper into the China Evergrande bankruptcy crisis, it’s evident that this is a multifaceted issue with profound consequences. How will Chinese authorities navigate this treacherous terrain? What will be the fate of Evergrande and the broader real estate industry? Join the conversation and share your insights on this unfolding economic saga. Your perspective could provide a fresh angle on this complex issue, shedding light on solutions that have yet to be explored.

In the face of uncertainty, the world watches as China Evergrande’s fate hangs in the balance, with implications that stretch far beyond its colossal debt. Stay tuned for more updates on this evolving financial saga as we continue to unravel the China Evergrande bankruptcy crisis at NewsBurrow News Network.

[ad_1]

China Evergrande Bankruptcy Crisis: Unraveling the World’s Biggest Property Developer

As the China Evergrande bankruptcy crisis continues to unfold, it’s becoming increasingly evident that the global financial landscape is facing turbulent times. The once-mighty property developer’s downfall serves as a stark reminder of the risks lurking in the world of high finance. With over $300 billion in debt, it’s a situation that has sent shockwaves through the economic world.

In the midst of this crisis, it’s crucial to consider how individuals and businesses can navigate these challenging financial waters. The keyword here is “Financial crisis survival.” In these uncertain times, being prepared and informed is more critical than ever. Whether you’re an investor, homeowner, or simply someone concerned about the broader economic implications, understanding how to safeguard your financial well-being is paramount.

In the following section, we’ll introduce you to valuable resources and products designed to help you weather this storm. We believe that by arming yourself with knowledge and the right tools, you can better secure your financial future in these turbulent times.

[ad_1]

Shop Products On Amazon

[ad_1]

Shop Products on Ebay

[ad_1]

Trending Similar Stories in the News

China Evergrande’s Problems Are Only Getting Worse The New York Times...

Timeline: China Evergrande's worsening debt crisis Reuters...

[ad_1]

Trending Videos of China Evergrande Bankruptcy Crisis

EVERGRANDE - DEFAULT & NON PAYMENT Claimed by Activist Bond Investor Preparing BANKRUPTCY PROCEDURES

EVERGRANDE UPDATE - Activist Bond Investor Plans BANKRUPTCY, Hengten Stock Sale & Electric Car Deal

[ad_2]

Similar Posts, Popular Now

UBS Department of Justice Probe

Framingham horse facility lawsuit

Criminal Justice Career Fair

Education Budget Bonuses

Progressive insurance policy changes

GIPHY App Key not set. Please check settings