Table of Contents

Us-china Trade War

China’s Fierce Retaliation: Trump’s Tariffs Spark Trade War!

US-China Trade War escalates as China swiftly retaliates against new tariffs, impacting tech giants and global markets.

Trade War Inferno: China’s Lightning-Fast Retaliation Against Trump’s Tariffs

The global economic stage is once again set ablaze as the US-China Trade War reignites. In a stunning turn of events, China has responded with remarkable speed to President Trump’s newly imposed tariffs, showcasing a level of economic agility that has caught many off guard. The implications of this rapid retaliation are far-reaching, potentially reshaping the landscape for businesses and consumers alike. NewsBurrow Network brings you an in-depth analysis of this escalating conflict, exploring the key players, the stakes, and what it all means for Pennsylvania and beyond.

The initial spark was lit when the Trump administration announced tariffs on a range of Chinese goods, citing concerns over trade imbalances and intellectual property theft. What followed was not a slow burn, but an immediate conflagration. Within minutes of the announcement, Beijing unveiled its counter-measures, signaling a clear intent to stand its ground in this high-stakes economic showdown. This isn’t just a trade skirmish; it’s a full-blown economic war, and Pennsylvania’s businesses need to understand the battle lines.

Tit-for-Tat: Understanding China’s Immediate Response to Trump’s Tariffs

China’s response wasn’t just swift; it was strategically calculated. The counter-tariffs targeted key sectors of the American economy, including energy and agriculture, sending a clear message that no sector would be immune from the fallout. This calculated approach aims to inflict maximum economic pain on the U.S., while simultaneously protecting China’s own strategic interests.

Specifically, China imposed tariffs on goods ranging from liquefied natural gas (LNG) to agricultural machinery, directly impacting states that heavily rely on these exports. The tariffs, set at 15% for LNG and 10% for agricultural machinery, are designed to hit where it hurts, creating ripple effects throughout the American economy. This aggressive posture signals a new level of intensity in the US-China Trade War, and businesses need to prepare for turbulent times ahead.

The timing of China’s retaliation is also significant. By responding almost immediately, Beijing sought to demonstrate its resolve and its ability to act decisively in the face of economic pressure. This move is not just about economics; it’s about projecting an image of strength and resilience on the global stage.

Google in the Crosshairs: Analyzing the Anti-Monopoly Probe

Perhaps the most eye-catching aspect of China’s response is the anti-monopoly investigation launched against Google. This move is seen by many as a direct shot at a major American tech giant, signaling that the US-China Trade War is expanding beyond traditional trade disputes and into the realm of technology and digital dominance. The investigation raises serious questions about the future of American tech companies operating in China.

The probe into Google’s business practices is a clear indication that China is willing to use all available tools to defend its economic interests. By targeting a high-profile American company, Beijing is sending a message that it will not hesitate to take action against firms it believes are engaging in unfair or anti-competitive practices. This move has sent shockwaves through the tech industry, raising concerns about the potential for further investigations and regulatory challenges.

The implications of this investigation are significant. If Google is found to be in violation of Chinese anti-monopoly laws, it could face hefty fines, restrictions on its operations, or even forced divestitures. This would not only impact Google’s bottom line but could also set a precedent for other American tech companies operating in China. The US China trade war impact is now directly affecting one of America’s most innovative companies.

Rare Metals and Export Restrictions: How China’s Strategy Impacts Global Tech

Beyond tariffs and anti-monopoly probes, China is also employing a more subtle but equally potent weapon in the US-China Trade War: export restrictions on rare metals. These metals, essential for the production of high-tech goods, are an area where China holds significant leverage. By limiting their export, Beijing can exert pressure on manufacturers around the world, including those in Pennsylvania, who rely on these materials.

The restrictions target metals like tungsten and indium, which are critical components in everything from smartphones to semiconductors. By controlling the supply of these materials, China can influence the production costs and competitiveness of companies in the U.S. and other countries. This strategic move highlights the complex interplay between trade, technology, and national security in the 21st century.

For Pennsylvania, which has a growing tech sector, these export restrictions could pose significant challenges. Companies that rely on rare metals for their manufacturing processes may face higher costs and supply chain disruptions. This underscores the importance of diversifying supply chains and investing in research and development to find alternative materials.

American Companies on Notice: PVH Group and Illumina Face Chinese Scrutiny

The US-China Trade War is not just about tariffs and macroeconomics; it’s about the fate of individual companies. The placement of PVH Group and Illumina on China’s “unreliable” list sends a chilling message to American businesses operating in the country. This designation suggests that these companies have allegedly violated Chinese regulations, potentially leading to repercussions ranging from fines to restrictions on their operations.

PVH Group, known for brands like Calvin Klein and Tommy Hilfiger, and Illumina, a leader in DNA sequencing, represent different sectors of the American economy. Their inclusion on the “unreliable” list suggests that China is willing to target companies across a wide range of industries in its effort to exert economic pressure. This has raised concerns among other American businesses operating in China, who fear that they could be next.

The move against PVH Group and Illumina serves as a stark reminder of the risks and uncertainties of doing business in China amid the US-China Trade War. Companies must carefully navigate the complex regulatory landscape and be prepared for potential challenges and disruptions.

Economic Fallout: Who Really Bears the Brunt of the Trade War?

The question on everyone’s mind is: who will ultimately suffer the most from the US-China Trade War? While both sides are likely to experience economic pain, analysts are divided on who will bear the brunt of the conflict. Some argue that China, with its heavy reliance on exports, has more to lose. Others contend that the U.S., with its dependence on Chinese goods, will face higher prices and supply chain disruptions.

One thing is clear: the impact of US tariffs on China will be significant. Chinese companies may struggle to compete in the global market, leading to job losses and economic slowdown. However, the U.S. is not immune. American consumers will likely face higher prices for goods imported from China, and businesses that rely on Chinese suppliers may struggle to find affordable alternatives.

For Pennsylvania, the economic consequences of the US-China Trade War are complex. The state’s manufacturing sector, which relies on both exports and imports, could be particularly vulnerable. It is crucial for Pennsylvania businesses to assess their exposure to the trade war and take steps to mitigate the potential risks.

A History of Trade Tensions: Contextualizing the Current Conflict

To fully understand the current US-China Trade War, it’s essential to look back at the history of trade tensions between the two countries. This is not a new phenomenon; rather, it’s the latest chapter in a long-running saga of disputes over trade imbalances, intellectual property, and market access. The Trump administration’s policies have simply intensified these existing tensions, leading to the current escalation.

Previous administrations have also grappled with these issues, employing a range of strategies from diplomatic negotiations to targeted sanctions. However, the Trump administration’s more aggressive approach, characterized by widespread tariffs and confrontational rhetoric, has marked a significant departure from the past. This has raised concerns among some experts who fear that it could lead to a prolonged and damaging trade war.

Understanding the historical context is crucial for Pennsylvania businesses as they navigate the challenges and opportunities presented by the US-China Trade War. By learning from the past, they can better anticipate future developments and make informed decisions about their operations and investments.

North American Trade Dynamics: How Canada and Mexico Fit into the Puzzle

While the US-China Trade War dominates the headlines, it’s important to remember that the U.S. is also engaged in trade disputes with other countries, including Canada and Mexico. The temporary halt to U.S. tariffs against these two nations adds another layer of complexity to the global trade landscape. It also highlights the interconnectedness of trade relationships and the potential for unexpected shifts and realignments.

The negotiations with Canada and Mexico, which resulted in the US-Mexico-Canada Agreement (USMCA), demonstrate that trade disputes can be resolved through negotiation and compromise. However, the fact that these negotiations were fraught with tension and uncertainty underscores the challenges of navigating the current global trade environment.

For Pennsylvania businesses, the dynamics of North American trade are just as important as the US-China Trade War. Many Pennsylvania companies rely on trade with Canada and Mexico, and any disruptions to these relationships could have significant consequences. It is crucial for businesses to stay informed about the latest developments in North American trade and to advocate for policies that promote stability and predictability.

Trump’s Tariff Strategy: More Than Just Trade?

Is the US-China Trade War simply about economics, or are there other factors at play? Some observers argue that President Trump’s tariff strategy is driven by broader political and strategic considerations. They point to his focus on issues like fentanyl and immigration as evidence that he is using trade as a tool to achieve broader foreign policy objectives.

By linking trade to these other issues, Trump is attempting to exert pressure on China and other countries to address concerns that go beyond economics. This approach has been praised by some as a bold and innovative way to advance American interests. However, it has also been criticized by others who argue that it risks undermining the stability of the global trading system.

Regardless of the motivations behind Trump’s tariff strategy, it is clear that the US-China Trade War is about more than just trade. It is a complex and multifaceted conflict with far-reaching implications for the global economy and international relations.

Navigating the Future: What’s Next for US-China Trade Relations?

The future of US-China Trade Relations is uncertain. Will the two countries reach a comprehensive trade agreement, or will the US-China Trade War continue to escalate? The answer to this question will have profound implications for businesses, consumers, and economies around the world. Upcoming negotiations between President Trump and Chinese President Xi Jinping could provide some clues, but it is unlikely that the underlying tensions will disappear anytime soon.

One potential scenario is that the two sides will reach a limited agreement that addresses some of the most pressing issues, such as intellectual property and market access. However, it is also possible that the negotiations will break down, leading to further tariffs and trade restrictions. In this case, the US-China Trade War could drag on for years, with significant consequences for the global economy.

For Pennsylvania businesses, the key to navigating the future is to stay informed, be flexible, and diversify their operations. By understanding the risks and opportunities presented by the US-China Trade War, they can position themselves for success in a rapidly changing world.

Conclusion: Charting a Course Through the Trade War Turbulence

The US-China Trade War is a complex and evolving situation with no easy answers. For Pennsylvania, the conflict presents both challenges and opportunities. By staying informed, adapting to changing conditions, and advocating for policies that promote stability and predictability, Pennsylvania businesses can weather the storm and emerge stronger than ever. NewsBurrow Network will continue to provide in-depth coverage and analysis of this critical issue, helping you navigate the turbulent waters of global trade.

The path forward requires strategic thinking, proactive planning, and a willingness to embrace change. Pennsylvania’s economic future depends on its ability to adapt and thrive in the face of these challenges. The US-China Trade War is not just a headline; it’s a reality that demands our attention and action.

What are your thoughts on the US-China Trade War? How is it affecting your business or community? Join the conversation and share your opinions with NewsBurrow Network and other readers.

By Ava Roberts (@AvaJournalism) – NewsBurrow Press Team

As the US-China Trade War continues to unfold, investors are keenly aware of the shifting dynamics and potential opportunities within the tech sector. The ripples of tariffs, export restrictions, and regulatory scrutiny are creating both winners and losers in the market. For savvy investors, understanding these trends is crucial for making informed decisions and capitalizing on emerging opportunities. This economic battleground presents a unique landscape where strategic investments in tech stocks can potentially yield significant returns, but also carries inherent risks that require careful consideration.

Given the volatility and uncertainty surrounding the US China trade war impact on the global economy, staying ahead of the curve is more critical than ever. Whether you’re a seasoned investor or just starting out, exploring the right tech stocks can be a strategic move. We’ve curated a selection of promising tech stocks that stand to benefit from the evolving trade landscape. Discover these potentially lucrative opportunities and take control of your financial future. Don’t forget to share your thoughts in the comments below and subscribe to NewsBurrow newsletters for the latest updates and insights!

Shop Products On Amazon

Shop Products on Ebay

Trending Similar Stories in the News

China launches limited tariffs after Trump imposes sweeping new levies Reuters...

China hits back at Donald Trump with tariffs on US Financial Times...

Trending Videos of Us-china Trade War

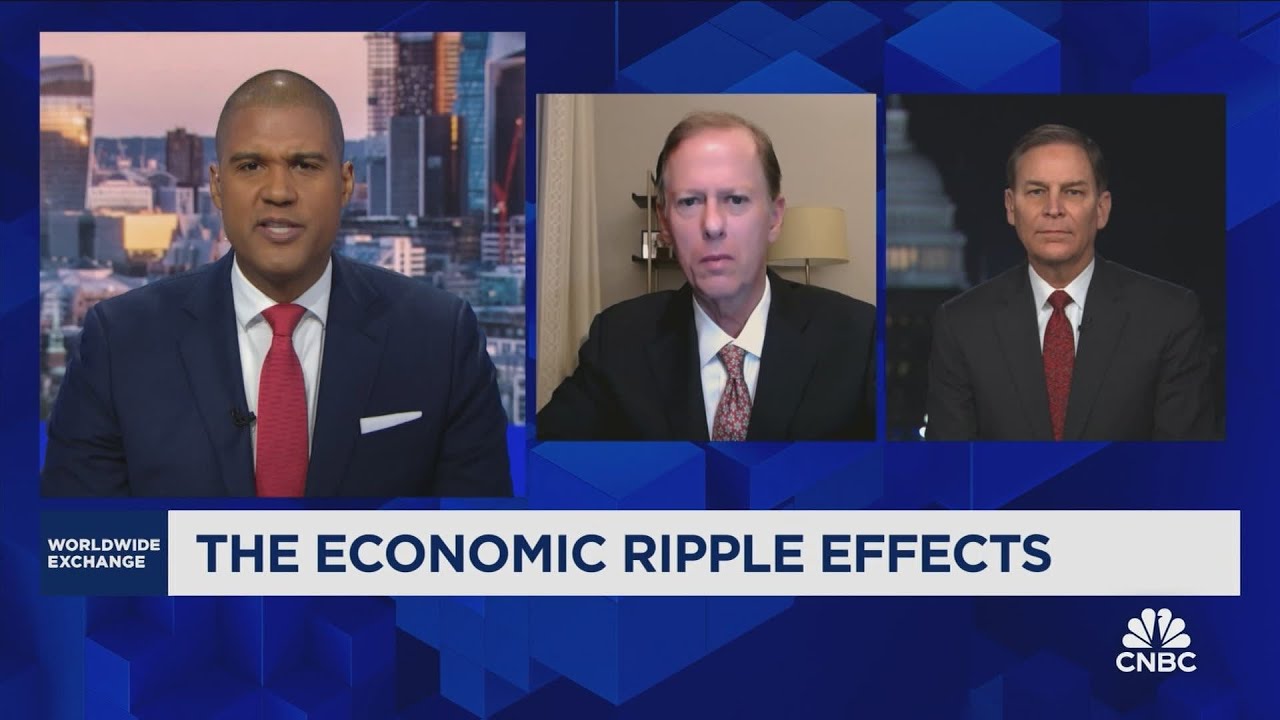

Tariffs disrupt U.S.-China trade relations, raising geopolitical risks, say experts

GIPHY App Key not set. Please check settings